Help and support

What's your question about?

FAQs

Fees and taxes

Our approach to fees is simple. We believe in:

- Radical transparency: We’ll always be upfront with any associated charges. We also want to ensure that we charge the smallest amount possible fairly, so if you place an order where the fees will account for 5% or more of its total value, you’ll be presented with a pop-up in the Lightyear app for you to confirm this.

- Honest pricing: Our fees are a combination of covering the costs associated with the service plus a small amount on top that we can reinvest to improve the business

See our pricing here.

Applicable taxes

Financial Transaction Tax

A financial transaction tax (FTT) is when a percentage of the asset's value is paid in taxes when traded. FTTs usually apply only to select financial instruments and often have varying tax rates depending on the asset type.

Stamp duty

Stamp duty is the tax governments place on legal documents, usually in the transfer of assets or property.

These taxes apply to anyone who is trading the applicable asset, irrespective of if you are a tax resident of that jurisdiction or not.

See more: here.

How are my assets protected?

NB! The protections mentioned in this article do not cover poor investment performance. It’s important to always remember that markets may go up or down, so you should never invest more than you can afford to lose.

How does Lightyear protect my funds and instruments?

Trusting us with your investments is not something we take for granted. Lightyear Europe AS is a licensed investment firm and as such is bound by strict regulatory obligations in how we handle and protect your assets. We do this via a process known as safeguarding.

Safeguarding means that, by law:

- Uninvested customer funds are stored separately from our business funds with regulated EU credit institutions and highest-rated qualifying money market funds. The primary institutions where we hold uninvested customer funds are ABN AMRO Bank in the Netherlands and in BlackRock qualifying money market funds rated AAA/mmf by Moody’s, S&P and Fitch. We also hold small amounts of customers' money in LHV Bank in Estonia

- Lightyear never uses customers' money or investments to cover its own needs, which also means that, unlike banks, for example, we do not lend customers' money out to third parties

- Invested assets are held with authorised custodians, which you can read more about in our Who is the owner of the securities I buy? help article. Customers are the owners of all their investments on Lightyear — your assets are held in separate accounts from Lightyear assets

- All customers' assets are inaccessible by our creditors and they would be returned to you in the unlikely event of Lightyear's insolvency

Are Lightyear customers covered by EU-wide asset guarantee schemes?

- Yes, all Lightyear customers have their assets covered up to the amount of 20,000 EUR by the Estonian Investor Protection Sectoral Fund. Read more about this fund here

- This protection covers all accounts regardless of the owner’s residency country. If you have a business account with us, your personal and any business accounts you have are separately covered up to the amount of 20,000 EUR across all your multi-currency balances

- This protection would come into action only in the most extreme cases if all safeguarding measures that are in place to protect your assets would fail. Lightyear never uses customers' money or investments to cover its own needs, which also means that, unlike banks, for example, we do not lend customers' money out to third parties. Therefore, in the event of a possible bankruptcy, your assets are intact and can be recovered in full. In other words, Lightyear's obligations to protect the client's assets are not limited to any maximum amount

- Read more about safeguarding above

Am I covered by the Securities Investor Protection Corporation (SIPC) protection in the US?

Your US securities are held with our partner Alpaca, who is FINRA regulated and a registered member of the SIPC. This means your US securities are protected up to the value of $500,000 should Alpaca fail. You can read more about this directly on the SIPC website.

What is a money market fund?

Money Market funds (MMFs) are a type of mutual fund that invests only in highly liquid, short-term debt from the likes of governments and financial institutions. These funds offer high liquidity with a very low level of risk and EU/UK regulations allow for brokerages to hold customer money in them. MMF is considered as a qualifying MMF if it meets higher regulatory standards for quality and liquidity than regular money market funds. In addition to offering protection via diversification, MMFs provide a return which we pass on to customers in the form of interest payments on uninvested cash you hold in your Lightyear account. To opt-out from keeping your money in a MMF, you can opt-out of interest in the app.

How does interest work?

You can hold uninvested money on your multi-currency account which can also earn interest.

Like most brokers, Lightyear earns interest on the cash it holds on your behalf in institutional bank accounts that are designed for financial firms to hold their customers’ money, as well as from holding your money in qualifying money market funds. Lightyear gets paid interest for holding customers' money and at a rate typically not available to retail customers. We have decided to pay this forward to you transparently.

**Earned daily, paid monthly on the 1st. To view current interest rates, check the Cash tab in the app or How does interest work).

Interest on uninvested cash: how it works

- You’ll start earning interest daily, on the same day as your deposit hits your Lightyear account

- We calculate the unpaid interest daily on the available uninvested cash balance of your investment account to five decimal places using the latest Lightyear rate. We then sum and round the unpaid interest amounts to two decimal places. Interest payments will be credited to your Lightyear account on the first of every month, and you can see the interest that you have been paid in the latest version of the Lightyear app and in your statements

- Money that’s been reserved for orders or other reasons does not accrue interest, and if you close your account before the next interest payment date, it won’t be paid out

For example, if 1,000 EUR is held for a whole year at the rate of 2%*

- 1,000 * 0.02 per year = 20 EUR per year

- 20 / 12 = 1.6 per month

*the rate may change, which we’ll notify you about.

See also our Tools & Calculators.

Taxes

For Estonian personal account customers, we automatically withhold your tax and pass it on to the Estonian Tax and Customs Board. If you live elsewhere, please note that you are responsible for the appropriate tax reporting and payments, in accordance with your local tax laws. You can opt out from earning interest by navigating to “Earn Interest” under the Settings page, which will cause any unpaid interest to be forfeited.

Protection

Earning interest on your uninvested money does not change the way your money is segregated or safeguarded. We always hold our customers’ uninvested money in segregated client money accounts in regulated EU credit institutions and highest-rated* money market funds, which you can read more about in our article How are my assets protected?.

It is important to note that the funds held in your Lightyear account are not equivalent to a bank deposit, and therefore in the unlikely event that all appropriate safeguards fail, funds are ultimately protected by the Investor Protection Sectoral Fund only for amounts up to 20,000 EUR in total across all your multi-currency account balances. Funds are not covered by the Deposit Guarantee Sectoral Fund, as it only covers bank deposits.

*rated AAA/mmf by Moody’s, S&P and Fitch

What is Lightyear?

Lightyear is a simple and approachable way to invest your money globally without unnecessary barriers or fees. We make investing approachable with a simple and easy to use app.

What problems are you solving?

- Expensive and opaque fee structures: Traditional players often have hidden and high cost fees

- Limited access to markets: Local brokers often offer bad access to global markets

- Limited information and education: Typically lacking or hard to understand

We’re at the beginning of our journey and haven’t solved the entire problem just yet, but believe that we’re already Lightyears ahead of the incumbents.

What do you offer?

We give you access to:

- A multi-currency account to deposit, hold and convert across three different currencies. Find out more by reading How does my multi-currency account work?

- Over 3500 mixed fractional and non-fractional stocks from US, UK and EU markets as well as access to international ETFs. This list is continually growing. See our Stock screener and Fund screener

Our mission does not stop there as we also believe in helping you become a better investor. To do this, we’re building bespoke tools that are tailored to your needs, no matter if you’re at the beginning of your investment journey or a seasoned expert.

In the app you’ll find:

- Custom charts

- Instrument fundamentals

- Analyst ratings & price targets

- Financials, news and more

We’re passionate about continuously evolving and ensuring you have the best tools available at your fingertips. Our services vary depending on where you are based. To find out exactly what you’ll have access to, see: What services do you offer and in which country?.

How much does it cost?

Visit our Fees and taxes article for more on the cost of using Lightyear.

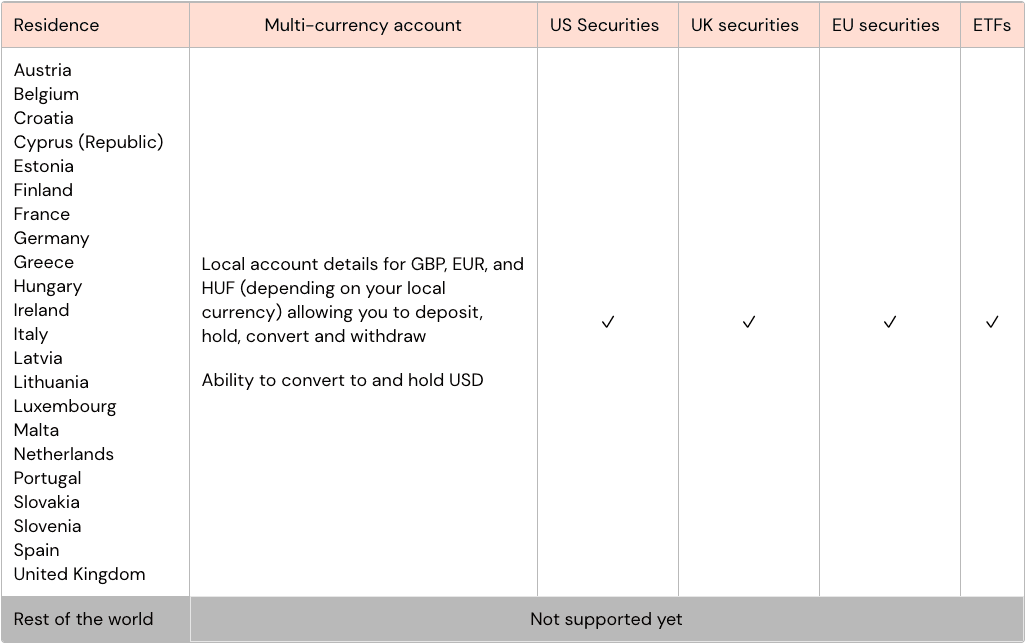

What services do you offer and in which country?

You have to be 18+ and an eligible person currently residing in the United Kingdom or select European countries to use our service today. We’re working hard on increasing this eligibility. Read more about what you’ll need to sign up here.

See what instruments we offer in our Stock screener and Fund screener. Products or services available to you vary depending on where you reside, see the below:

We unfortunately can’t offer you our services if you reside outside of the UK or the above listed EU countries but, fear not, we’re working hard on expanding. As well, if you are a citizen or tax resident of the United States, or if certain legal or regulatory restrictions apply in other cases, we can’t offer you our products or services just yet.

At the moment, we don’t offer options, CFDs, futures trading, short-selling, or pre-market and after-hours trading.

Withdrawals

We only send your (or your business's) funds to a bank account in the name of the Lightyear account holder.

How to withdraw funds in the app?

- Tap on the “Withdraw” button in the corresponding currency account

- If you’ve already made a bank transfer into your Lightyear account, your bank account is saved to your profile and you can withdraw without any extra steps

- In case you’ve only deposited using Apple/Google Pay or Debit card options, we don’t have your bank account details yet, so keep them at hand and the app will guide you through how to add them

How long can a withdrawal take?

Once requested, withdrawals may take up to 2 business days to be processed before being sent out to your requested bank account. Transfer times depends on the payout method and once initiated cannot be cancelled. For GBP, EUR, and HUF, your funds should typically arrive within the same banking day. For USD, your funds should typically arrive within 2 banking days after processing.

Can I withdraw the USD I have on my USD account?

USD withdrawals are available to local US bank details. Should you wish to withdraw USD to a US bank account, please contact our Support team below and include a document issued by your bank that includes your name as the account holder as well as the ACH routing number and account number. If you don’t have a local US bank account, you need to convert your funds to your local currency (GBP, EUR, or HUF), which will have a FX fee of 0.35%, before placing a withdrawal request (see Fees and taxes).

The bank account I deposited from is not available as a withdrawal account

If you deposited from an account that does not offer local account details in that currency, you can’t withdraw funds back to it (e.g. you deposited USD from a bank account that has an IBAN).

If you deposited from Wise, at this time, we are unable to verify Wise balance account details in any currency even after successfully receiving a deposit. Should you wish to withdraw to Wise account details, please contact our Support team below and include the account details document (Hungarian: számlaadatokat igazoló dokumentum) issued by Wise for the respective currency in PDF format. Please note that we cannot accept screenshots and require the document issued by Wise.

Why won’t my withdrawal work?

- You don’t have your bank account in the currency you’re trying to withdraw connected to your Lightyear account. You'd need to either convert your funds before withdrawing or add a bank account first by making a deposit or if offered, tapping on “Create bank account” when withdrawing

- You don’t have any funds in the currency you're attempting to withdraw and need to convert before withdrawing

- You are not holding uninvested cash but open positions only

- Promotional/referral reward can only be withdrawn 30 days after having received it. See Lightyear Sign-up Promotion Terms and Lightyear Refer a Friend Terms

- You are attempting to add non-local account details as a withdrawal account (e.g. IBAN for USD transfers)

- If none of the above apply, feel free to reach out to us

See also: Everything about deposits and How can I deposit USD?