Bye bye Shareworks.

Hello Lightyear.

When you invest, your capital is at risk. Switching brokers may have cost implications.

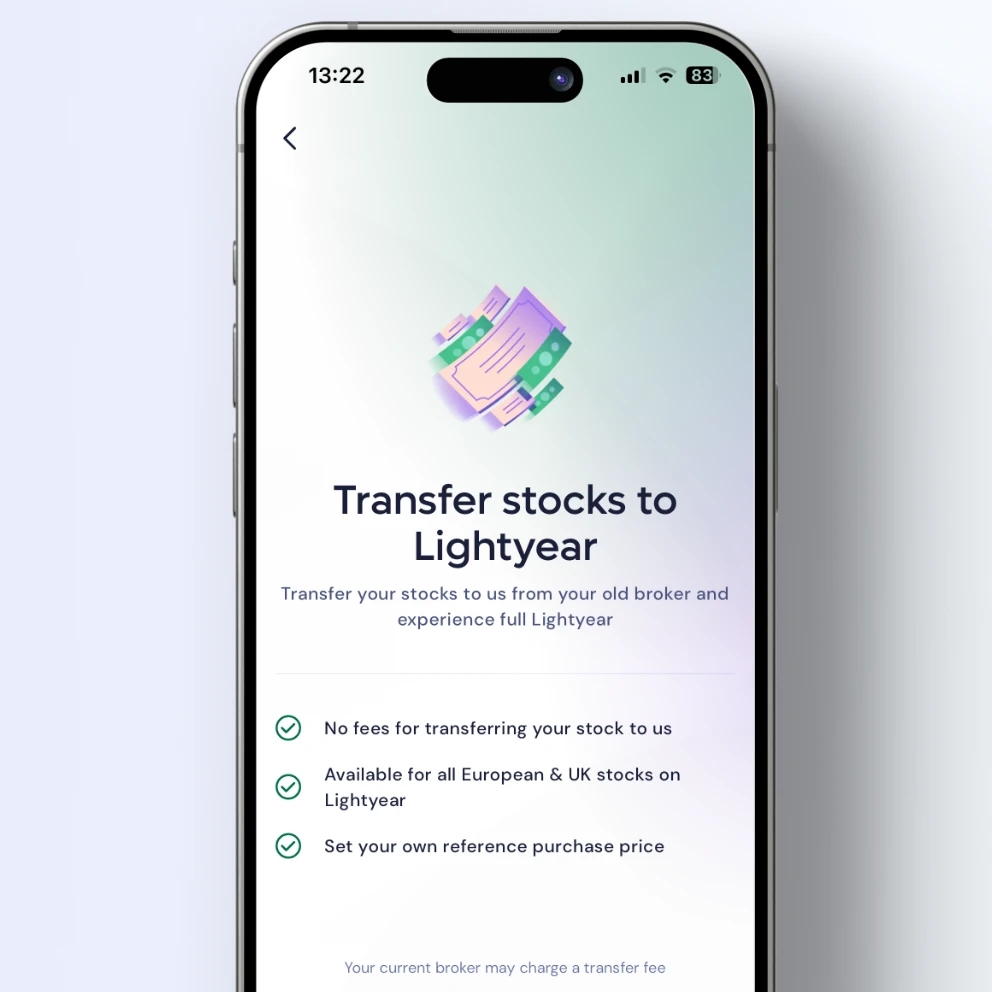

No fee to transfer from Shareworks

1. Initiate a stock transfer

2. Create the order in Shareworks

3. Sit back and relax!

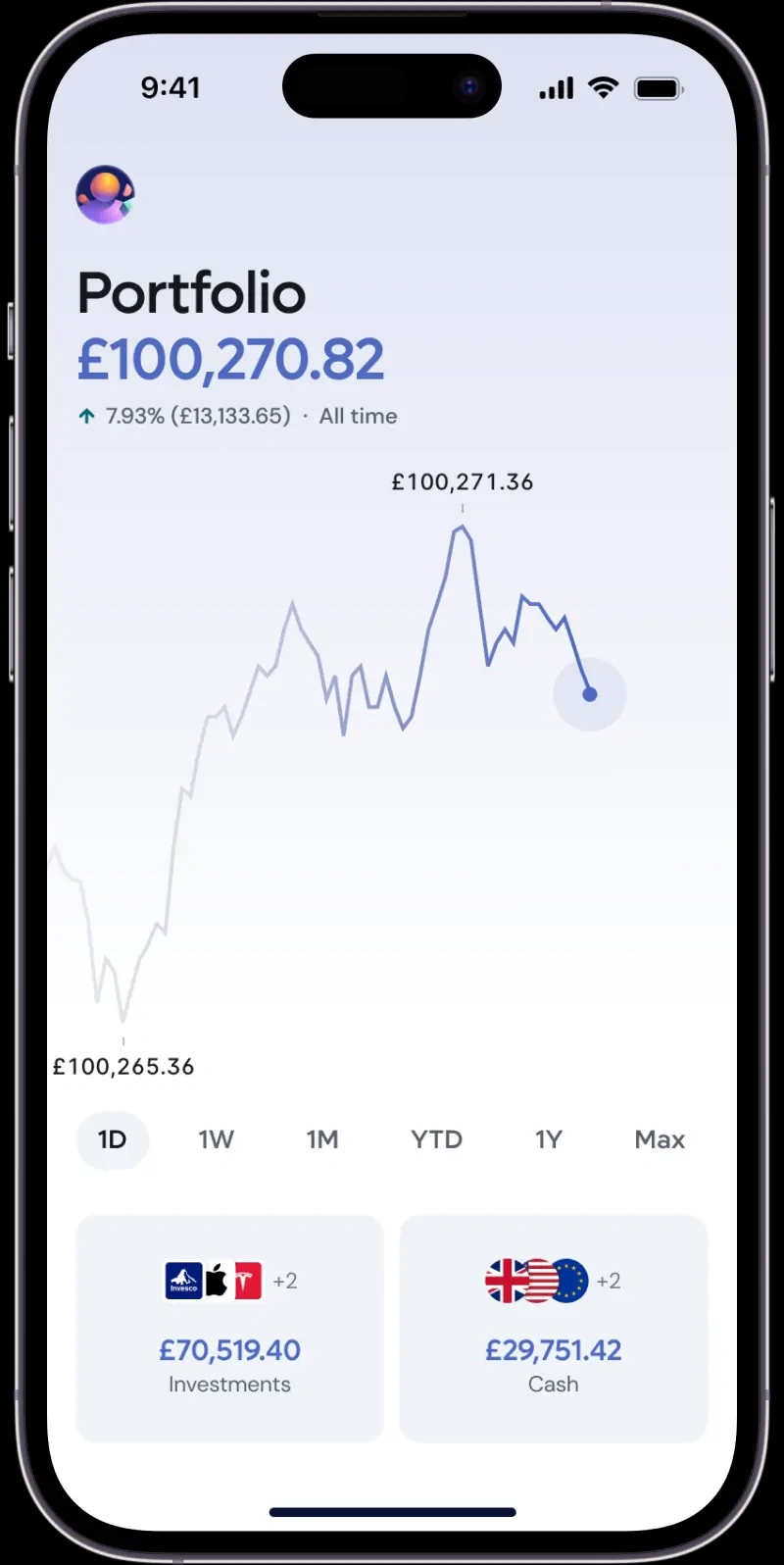

The process of transferring from Shareworks to Lightyear was very smooth, and the shares arrived in my account in around 5 business days. This is my first time using Lightyear - it’s really simple and intuitive, with lovely UI design. I’d happily recommend it to others.

Joseph McCormick

Head of Video, Hotjar

Say goodbye to old-school brokers

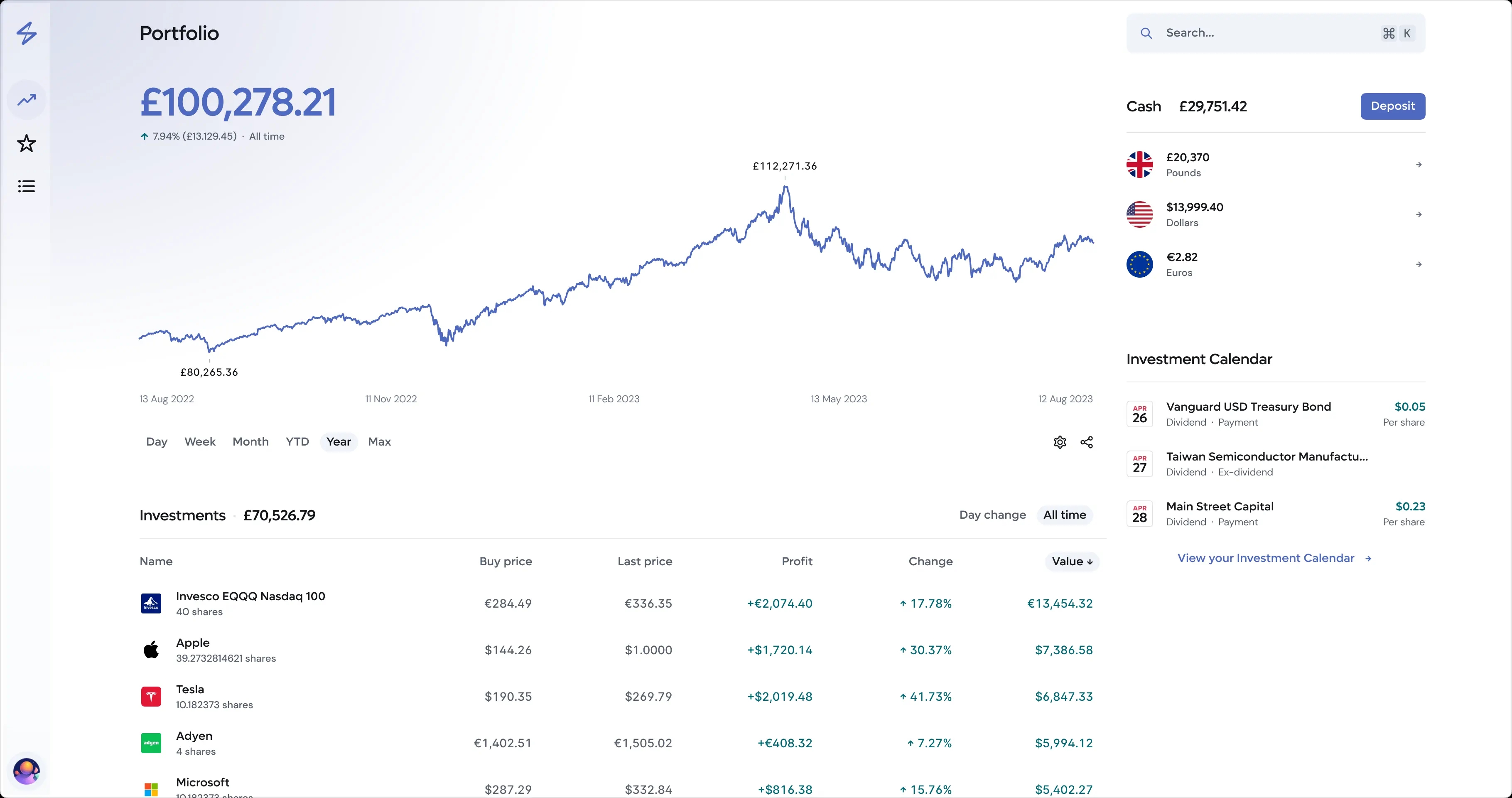

3,000+ US stocks across the NYSE and Nasdaq.

How we compare

|  |  | ||

|---|---|---|---|---|

ETFs | Free | Free | £5.99 | £11.95 |

Monthly fee | Free | £5.99 | £9.99 | Free |

US shares per successful order | $1 max | 0.59% FX fee | £5.99 | £11.95 + 0.75% Dealing & FX fee |

UK shares per successful order | £1 | Free | £5.99 | £11.95 |

EU shares per successful order | 1€ | 0.59% FX fee | £5.99 | £11.95 + 0.75% Dealing & FX fee |

Currency conversion (FX) | 0.35% | 0.59% | 1.50% | 0.75% |

Multi-currency | ||||

Interest on GBP | 4.50% | 1.00% Up to £2K | 1.10% | 1.00% |

Interest on USD | 4.50% | 1.10% | ||

Interest on EUR | 3.25% |

Pricing comparison of other providers as of 3rd of April 2023 based on a portfolio of £8,000. Information displayed on the table above is based on competitors' websites information. For the most up to date information please visit their respective websites.

Freetrade: Offers 3 different plans. In the above table the Standard plan is presented with a monthly fee of £5.99 that can be reduced to £4.99 if paid yearly. Other plans are basic which is free with a 0.99% FX Fee or plus which is £11.99 (£9.99 if paid annually) with a 0.39% FX fee.

Revolut: Offers 4 different plans. In the above the Standard plan is presented which is their free version which offers also a first trade for free each month . Revolut also offers a plus, premium and metal plans, priced £2.99, £6.99, £12.99 respectively. Offered interest would go up to 1.38% for plus, 2.34% for premium and 2.75% for metal. Standard and plus plans are subjected to and FX fee of 0.5% after the first £1,000 but this fee is waived in Premium and Metal plan.

Interactive investors: Offers 4 different plans. In the above table the Investor plan is presented which offers a credit of £5.99 which is equivalent to the first trade free. Other plans are Investor Essentials, Super Investor and Pension Builder, priced £4.99, £19.99, £12.99 respectively. UK shares and funds and US shares per trade are reduced to £3.99 on the Super investor plan. Interest rates are tiered offering 0.5% on the first £10.000 and 1% over £10.000. FX fee is also tiered and would work as follows. £25,000 - £49,999 are 1.25%, £50,000 - £99,999.99 are 1%, £100,000 - £599,999 are 0.5%, and £600,000 - £999,999.99 are 0.25%.

Hargreaves Lansdown: Trade cost is based on the number of trades in the previous month. £11.95 fee is the first tier from 1 to 9 trades in the previous month. £8.95 per trade for 10-19 trades and £5.95 for 20 or more trades. At the same time FX is also tiered with 1.00% FX fee on the first £5.000 and reduces to 0.75% after the first £5,000, 0.5% after £10,000 and 0.25% over £20,000. Interest rates are also tiered with 1% up to £9.999, 1.20% from £10,000 to £49.999.99, 1.40% from £50,00 to £99,999.99 and 1.60% for over £100,000.00.

Questions we’re often asked

Which stocks can I transfer from Shareworks?

How long will a transfer from Shareworks take?

How much does it cost to transfer from Shareworks?

What happens to any dividends while the transfer is in progress?

How do you keep my money safe?

Trusting us with your money is not something we take for granted. Lightyear Europe AS is a licensed investment firm and as such is bound by strict regulatory obligations in how we handle and protect your assets.

Customer assets always sit separately to our own and are held by authorised custodians. There’s no way for creditors - in the unlikely event of anything happening to Lightyear - to get hold of the investments or cash that you hold with us.

Lightyear customers have their assets covered up to the amount of 20,000 EUR by the Estonian Investor Protection Sectoral Fund. Read more about this fund here. Your US securities are held with our partner Alpaca, who is FINRA regulated and a registered member of the SIPC. This means your US securities are protected up to the value of $500,000 should Alpaca fail. You can read more about this directly on the SIPC website.

Read more about how your assets are protected in our help centre.

Is Lightyear a bank?

How easy is it to withdraw my money?

Easy. We ensure you always have access to your money and we’ve made the process pretty painless for when you need to withdraw. The transfer times depend on the payout method you’re using but never longer than a day or two. For GBP, EUR, and HUF, your funds typically arrive on the very same day. For USD, your funds typically arrive within two days.

Note that at this time, we don't support direct stock transfers out of Lightyear accounts. We're working on adding this feature. Until then, you can liquidate your positions and transfer the funds back to your bank account.